How to request a shopping invoice after purchasing at Z2U?

1. Basic process of requesting invoices

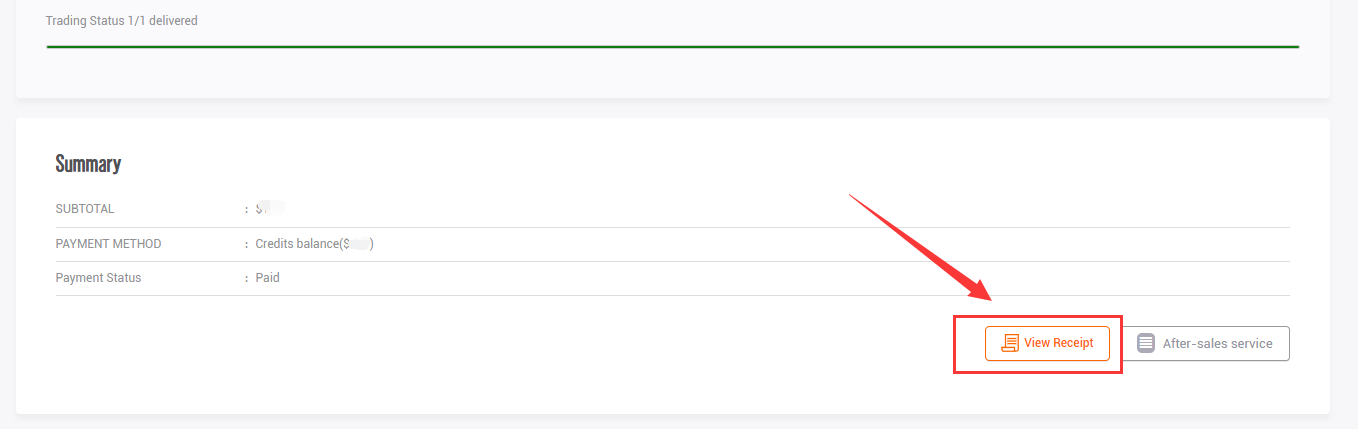

On the Z2U trading platform, we have prepared a proforma invoice for users, which can help users prove their purchase in any case. How to check: After confirming the receipt of the order, click "View Receipt" on the order details page.

If buyers from mainland China need VAT invoices, we suggest you contact the seller directly and request the VAT invoice. As a game service guarantee platform, Z2U does not directly provide VAT invoice issuance services, but we will supervise and assist the communication between buyers and sellers to ensure a smooth and compliant transaction process.

Generally, you need to provide the seller with the following information: the name, quantity, unit price, and total amount of the purchased goods; your full name or company name; your tax number (if the purchase is for a company and a special VAT invoice is required); and your permanent address and contact information to ensure that the invoice information is correct.

Q: What role does the Z2U platform play in the process of requesting VAT invoices?

A: Z2U platform mainly plays the role of supervision and assistance in the process of VAT invoice requests. We are committed to providing a safe and transparent trading environment to ensure that the legitimate rights and interests of buyers and sellers are protected. On the issue of invoice requests, we will actively intervene and coordinate to resolve possible arguments or problems in accordance with platform rules and relevant laws and regulations.

2. Invoice types and tax-related issues

Q1: What kind of invoice can I ask the seller to issue?

A: Overseas users can use the proforma invoice generated by the Z2U platform for orders as proof of purchase.

In mainland China, common invoice types include general VAT invoices and special VAT invoices. The specific type of invoice that can be issued depends on the seller's qualifications and your purchase needs. Generally, individual buyers can only obtain general VAT invoices, while corporate buyers can request special VAT invoices after providing complete tax information.

Q2: How is the tax rate on invoices calculated?

A: The tax rate on the invoice depends on the type of goods or services and the seller's tax status. The specific tax rate should be declared and paid by the seller in accordance with relevant laws and regulations.

3. Common Problems in the Invoice Request Process

Q1: What should I pay attention to when requesting an invoice?

A: When requesting an invoice, please ensure that the information you provide is accurate to avoid invalid invoices or other tax issues due to incorrect information. At the same time, please pay attention to protecting your personal privacy and tax information security to avoid leaking it to unrelated third parties.

Q2: Can individual sellers issue invoices?

A: Individual sellers are unable to issue formal VAT invoices, as VAT invoices are usually issued by registered companies/corporations. Individual sellers can issue simple receipts, but such receipts do not have the legal effect of tax invoices.

Q3: How do I request an invoice or receipt from an individual seller?

A: If you need an invoice or receipt, please communicate clearly with the individual seller before purchasing to confirm whether they can provide relevant documents. If the individual seller can provide a receipt, you can provide them with the necessary purchase information, including product name, amount, date, etc., so that they can issue a receipt. Please note that the legality and tax validity of receipts may be limited and are usually applicable in informal occasions.

If an individual seller cannot issue an invoice, Z2U recommends you clarify your needs and requirements with the seller before submitting the order. If the invoice is important to you, it is recommended to choose a corporate seller to trade with to ensure that you can obtain a legal and valid VAT invoice.

Q4: If the individual seller cannot provide an invoice, what rights does the buyer have?

A: If an individual seller cannot provide an invoice, the buyer's legal rights are usually limited because the invoice is the official transaction voucher. If you need a formal invoice for reimbursement or other tax processing, it is recommended to choose a seller with invoicing qualifications to trade with. When trading with an individual seller, please confirm in advance whether they can provide an invoice to avoid unnecessary trouble later.

Q5: What if the seller refuses to issue an invoice?

A: If the seller refuses to issue an invoice without a legitimate reason ( for example, the seller is a corporate seller with invoicing qualifications but refused to provide an invoice without reasons), you can contact the Z2U service team and file a complaint against the seller. Z2U will investigate and take appropriate measures against the seller according to the platform rules to protect your legal rights.

Q6: What should I do if the invoice information I received is incorrect?

A: If the invoice information you received is incorrect, please contact the seller to correct it in time. If the seller does not cooperate, you can also seek help from the Z2U customer service, and we will assist you in communicating with the seller to resolve the problem.

4. Other matters needing attention

Q: Can receipts from individual sellers be used for reimbursement?

A: Receipts from individual sellers are usually not accepted by the tax authorities as reimbursement documents, especially in the case of corporate reimbursement. Corporate reimbursement generally requires a VAT invoice. For personal use or small-amount consumption, receipts may be accepted, but the specific requirements should be confirmed according to the reimbursement policy and tax regulations of the unit.